Finance

TraceLoans.com Credit Score: Understanding How Credit Scores Shape Online Lending Decisions

Introduction to TraceLoans.com and Credit Scores

TraceLoans.com credit score discussions usually come up when people start exploring online lending platforms and want to understand how creditworthiness affects loan eligibility. Credit scores play a central role in almost every modern lending decision, especially in digital-first financial services.

Online loan platforms like TraceLoans.com operate in a competitive environment where speed, automation, and risk assessment are crucial. Credit scores help lenders quickly evaluate an applicant’s financial behavior without lengthy manual reviews.

From an expert perspective, understanding how credit scores interact with platforms like TraceLoans.com empowers borrowers to make smarter decisions. It shifts the focus from confusion to clarity, especially for first-time or credit-conscious borrowers.

What a Credit Score Really Represents

A credit score is a numerical summary of an individual’s credit behavior. It reflects how responsibly someone has managed borrowing, repayments, and overall financial commitments over time.

Factors such as payment history, credit utilization, length of credit history, and recent inquiries all influence the score. Contrary to popular belief, income alone does not determine creditworthiness.

Experts emphasize that a credit score is not a judgment of character. It is a financial risk assessment tool used to predict the likelihood of repayment, especially in automated lending environments.

How Online Lending Platforms Use Credit Scores

Platforms like TraceLoans.com rely heavily on credit scores to streamline loan approvals. Automated systems analyze scores alongside other data points to assess risk efficiently.

A higher credit score typically signals lower risk, which may result in better loan terms, faster approvals, or higher borrowing limits. Lower scores may still qualify but often under stricter conditions.

From a technical standpoint, credit scoring allows online platforms to scale operations. Instead of manual underwriting, algorithms make consistent decisions based on established risk models.

TraceLoans.com Credit Score Requirements Explained

While specific requirements vary, TraceLoans.com credit score considerations generally align with industry standards. Applicants are usually evaluated within a credit score range that reflects acceptable risk levels.

Some borrowers assume that online lenders only cater to high-score applicants, but that is not always the case. Many platforms consider a broader spectrum, including fair or average credit profiles.

Experts advise borrowers to read eligibility criteria carefully. Understanding minimum expectations helps avoid unnecessary applications that could impact credit through repeated inquiries.

Credit Score Impact on Loan Approval and Terms

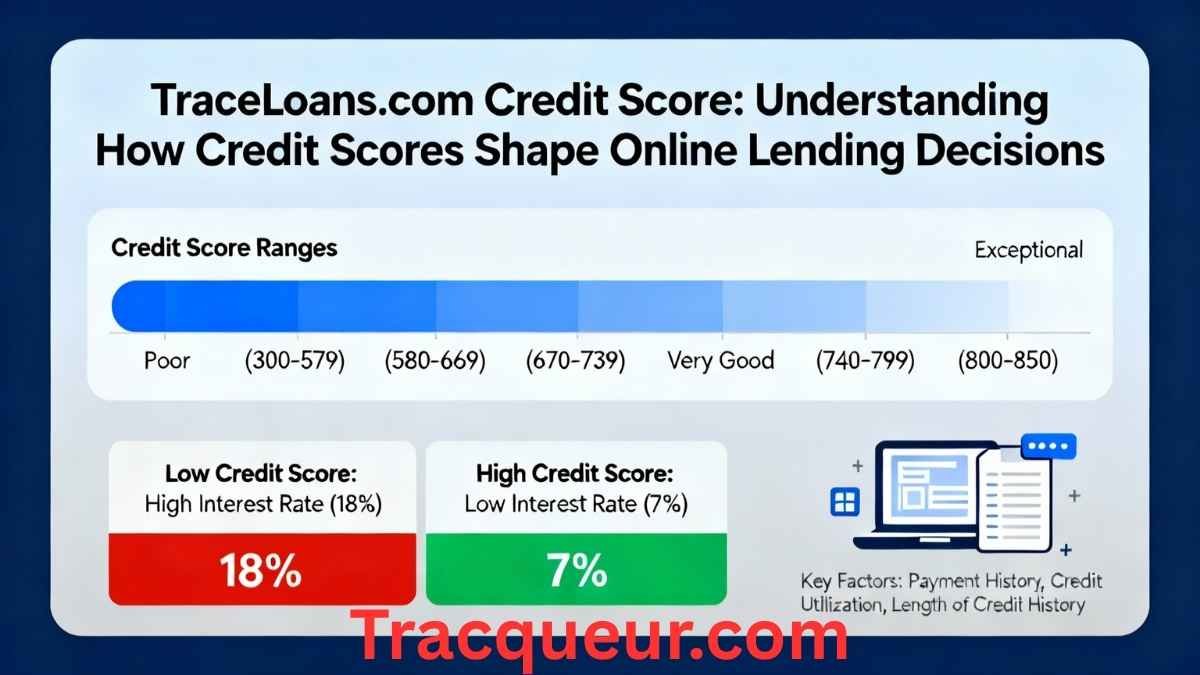

Credit scores do more than determine approval; they influence loan structure. Interest rates, repayment periods, and fees are often directly tied to score ranges.

A stronger credit score typically results in lower interest rates, reducing the overall cost of borrowing. This difference can be significant over the life of a loan.

From a financial planning perspective, improving credit before applying can lead to long-term savings. Even small score increases can result in better loan conditions.

Common Credit Score Misconceptions

One common misconception is that checking your own credit score lowers it. In reality, soft checks do not affect scores, while hard inquiries from loan applications may.

Another myth is that closing old accounts improves credit. In many cases, this can shorten credit history and negatively impact scores.

Experts stress the importance of accurate information. Misunderstanding credit behavior often leads to decisions that unintentionally harm financial health.

Improving Your Credit Score Before Applying

Improving a credit score does not happen overnight, but consistent habits make a difference. Paying bills on time remains the most impactful factor.

Reducing credit card balances and avoiding unnecessary new credit applications also help stabilize scores. Small adjustments can produce noticeable improvements over time.

From an expert standpoint, preparation matters. Borrowers who plan ahead often secure better outcomes when applying through platforms like TraceLoans.com.

Alternative Factors Beyond Credit Scores

While credit scores are important, many online platforms consider additional data. Income stability, employment history, and existing debt levels may also be evaluated.

Some platforms use alternative data models to assess borrowers with limited credit history. This approach helps expand access without compromising risk management.

Experts view this trend as a positive evolution. It recognizes that financial responsibility can exist beyond traditional credit scoring systems.

Responsible Borrowing and Financial Awareness

Understanding TraceLoans.com credit score requirements encourages responsible borrowing. Loans should be tools for growth, not sources of long-term financial strain.

Borrowers are advised to assess affordability before applying. Knowing repayment obligations helps prevent missed payments that could damage credit further.

From a financial literacy perspective, awareness leads to better decisions. Responsible borrowing supports both personal stability and long-term credit health.

Security and Data Protection Considerations

When applying online, borrowers often share sensitive financial data. Platforms like TraceLoans.com are expected to use secure systems to protect this information.

Encryption, verification processes, and secure data handling are essential for maintaining trust. Users should also take steps to protect their own devices and credentials.

Experts recommend caution and research. Understanding privacy policies and platform credibility is part of responsible financial engagement.

The Future of Credit Scoring and Online Lending

Credit scoring models are evolving. New technologies and data sources are shaping more inclusive and accurate assessments.

Online platforms will likely continue refining how they evaluate creditworthiness. This could lead to fairer access and more personalized loan offerings.

From an expert perspective, adaptability is key. Borrowers who stay informed about credit trends will benefit most from future lending innovations.

Final Thoughts on TraceLoans.com Credit Score

TraceLoans.com credit score discussions highlight the importance of understanding how modern lending works. Credit scores remain central, but they are part of a broader financial picture.

Borrowers who understand their credit position are better equipped to navigate online lending platforms confidently. Knowledge reduces uncertainty and improves outcomes.

Ultimately, credit scores are tools, not barriers. When approached with awareness and preparation, platforms like TraceLoans.com can support informed and responsible borrowing decisions.

-

Entertainment3 days ago

Entertainment3 days agoFakboitv: Exploring the Digital Identity Behind a Rising Online Brand

-

General7 days ago

Do Government Grants Cover Heat Pump Installation?

-

Beauty & Skincare1 week ago

Beauty & Skincare1 week agoSerumcu: Understanding the Term Its Uses and Its Growing Relevance

-

General1 week ago

General1 week agoRolerek: Meaning Usage and Its Place in Modern Digital Culture

-

Entertainment1 week ago

Entertainment1 week agoNinewin: Understanding the Platform Digital Appeal and User Experience

-

Food1 week ago

Food1 week agoBjudlunch: A Simple Guide to Sweden’s Most Thoughtful Lunch Tradition

-

General5 days ago

General5 days agoOrdenari: Redefining Structure Simplicity and Smart Organization in the Modern World

-

Entertainment5 days ago

Entertainment5 days agoTabootune: Redefining Bold Expression in the Digital Sound Era